As an academic exercise let’s imagine that our offering had been available for as long as the S&P 500 Index has been around.

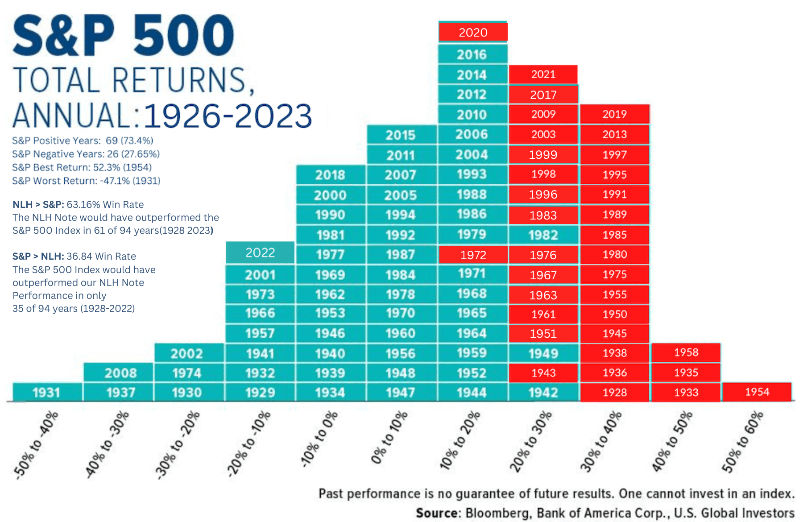

If that were the the case then the Next Level Fully Insured Principal & Interest Protected Fixed Income Note™️ “Enhanced Annuity with a 15% annual percentage yield would have outperformed the S&P 500 Index in 61 out of the last 94 years or 63.16% of the time since the inception of the index.

The S&P 500 Index had a return of over 15% in only 35 out of the last 94 years. Which means that our investors whom earn a 15% yield while also enjoying absolute principal and interest protection would have a 63.16% chance of beating the S&P 500 Index; assuming we apply historical performance benchmarks to extrapolate future returns.

The best part is while our investors are enjoying these index crushing returns; they remain protected under the blanket of full Insurance Protection!

Here is a chart which will help you to put that into perspective:

Legend:

Translate

Translate