GUARANTEED INCOME WITH OUR ENHANCED ANNUITY PRODUCT | THE PRINCIPAL & INTEREST PROTECTED NOTE ™ WITH FULL INSURANCE PROTECTION

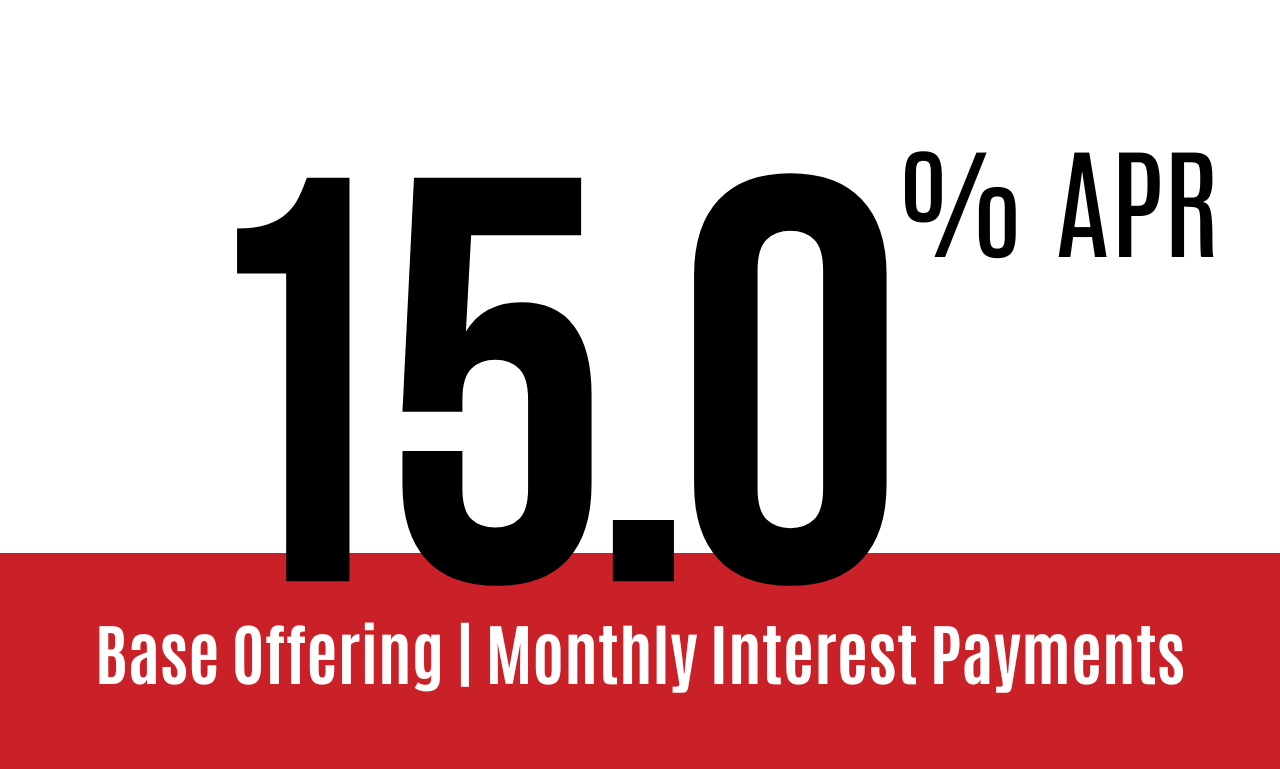

EARN 1.25% PER MONTH GUARANTEED! (15% APR)

Now you don’t have to chase the wildly unpredictable and whimsical returns offered by the stock market!

Nor do you need to accept the paltry yields traditional annuities offer in exchange for a guaranteed fixed rate product! Now you can get the same investment grade insurance carrier issued guarantees that come with standard or traditional annuities without trading away an attractive yield and sacrificing a healthy return on your hard earned investment.

Next Level Holdings offers investors the unmatched opportunity to invest in our critically acclaimed enhanced annuity offering which affords our clients access to our principal & interest protected fixed income note™ which is a fully insured and guaranteed investment vehicle with fixed rates of return of up to 15.5% per year.

Say goodbye to standard annuities and say hello to enhanced annuities with enhanced yields ushering in an enhanced quality of life!

You asked for it and we delivered. Now It’s time to conquer hyper-inflation, earn risk adjusted superior yields and secure the retirement that you deserve. Your Welcome!

CLICK HERE FOR INVESTMENT OFFERINGINVESTMENT SUMMARY

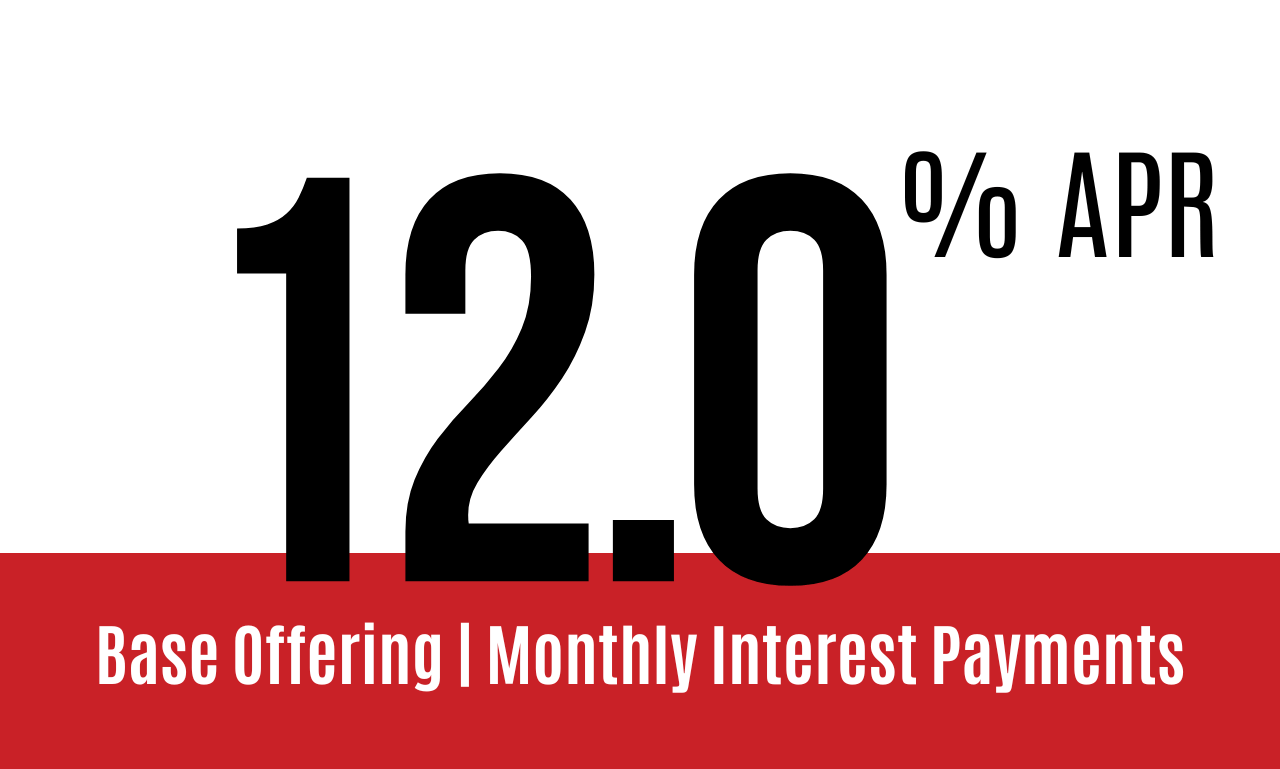

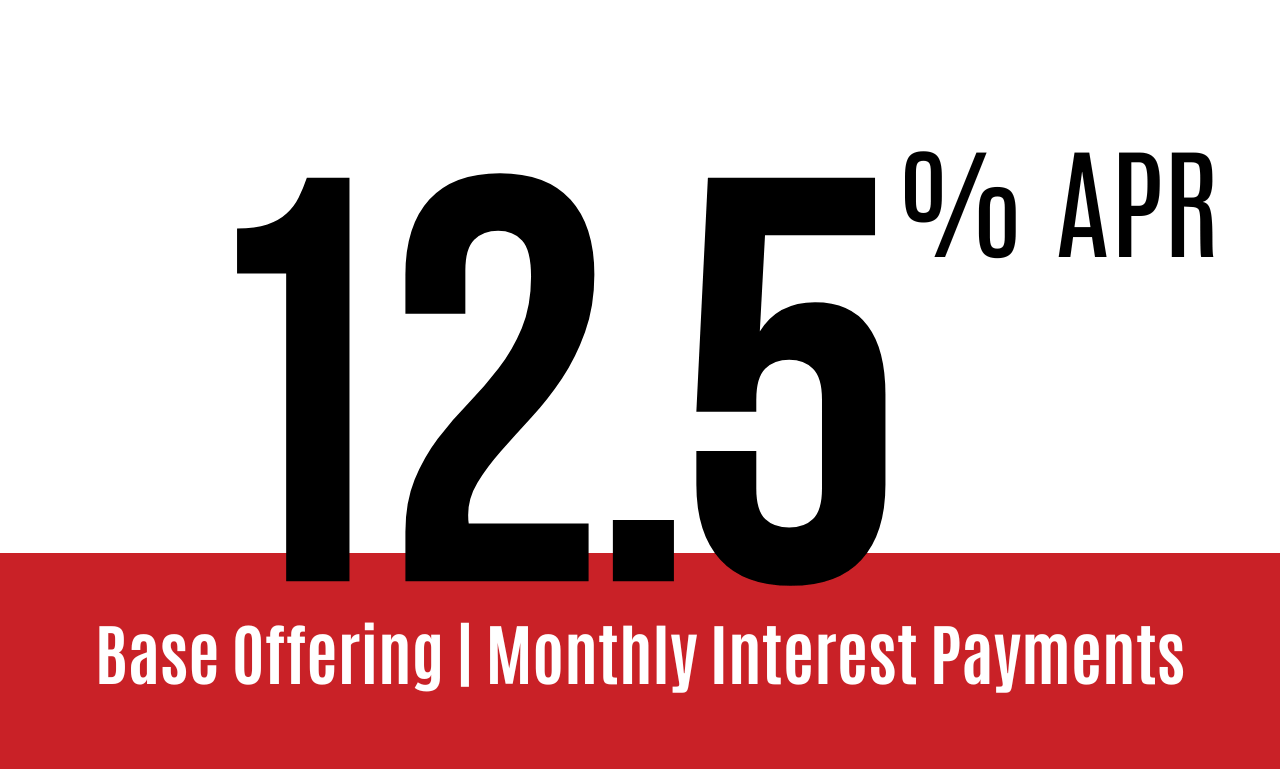

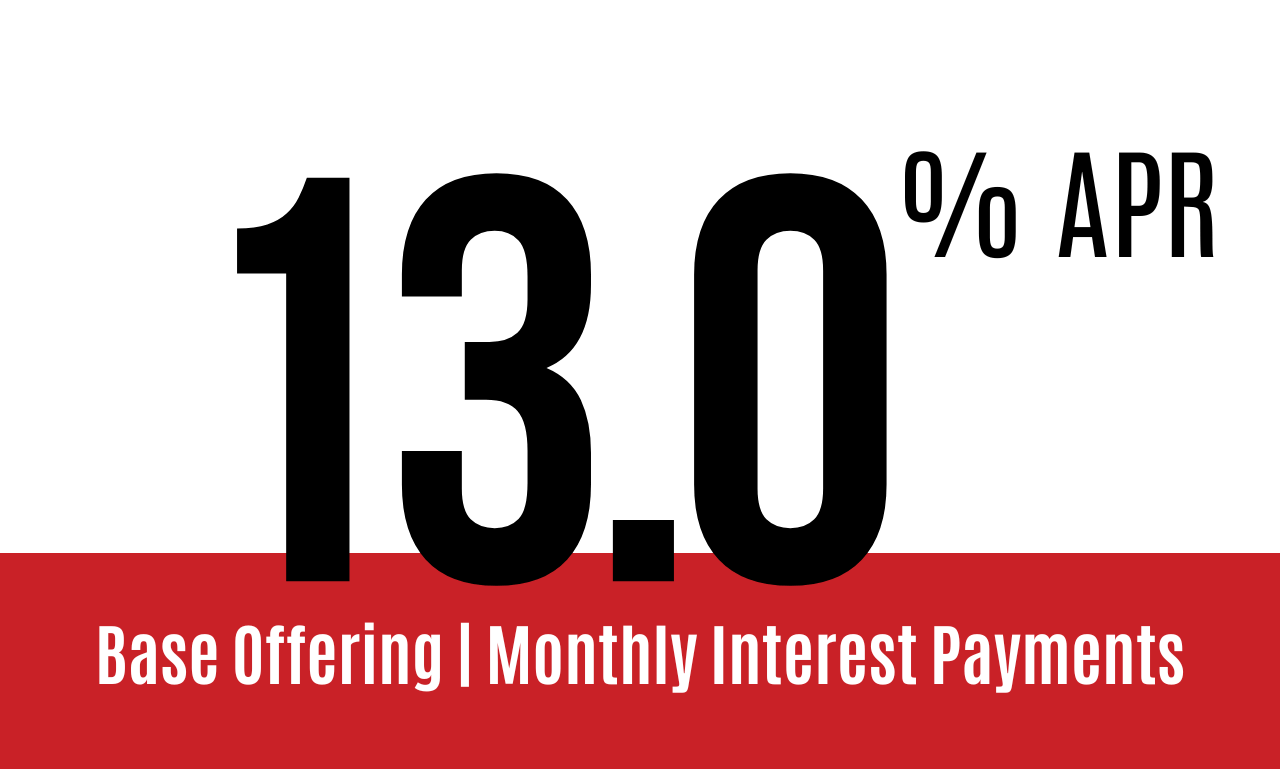

Next Level Holdings provides investors with the opportunity to leverage our enhanced annuity products which are fully insured and fully guaranteed note investments that generate predictable monthly income and double-digit returns between 12.0% to 15.0% per year.

Our unique enhanced annuity offering(s) are the perfect alternative to standard or traditional annuity offering(s) as you have the same iron clad guarantees from AM Best top rated insurance carriers, but with the incredible benefit of a 15.0% APY as opposed to a 6.0% APY which is the average yield with any standard or traditional annuity product. You deserve more, and we are here to make sure you get it!

Featured In

INSURANCE PARTNERS

Investor Objectives

Next Level Holdings’s objectives are to provide Investors with:

HIGH YIELD RETURNS

Our Fully Insured & Interest Protected Fixed Income Note™️ Enhanced Annuity Product delivers rates of return that are higher than the bank’s traditional low-yield bonds, higher than any stock dividend, higher then any traditional annuity product(s) and our 15.0% APY actually outperformed the S&P Index 61 out of the last 94 years or 63.16% of the time since the inception of the S&P Index way back in 1926, the year that John Logie Baird conducted the first public demonstration of a television.

REGULAR INCOME

All our investors are different and have different lives and different goals. Whether you prefer to receive your interest each month, each quarter or once a year —you deserve to have it your way.

Set yourself up for a comfortable retirement, prepare for increased monthly living expenses, and combat hyperinflation while you build your savings account. Act like a savvy investor and replace your high expense, underperforming, paltry annuity income now with an enhanced annuity product that has been customized with a tailored fit just for you and your unique needs.

IRA FRIENDLY

The only thing better than guaranteed fully insured market beating returns is enjoying guaranteed fully insured market beating returns in your qualified IRA account.

With the help of our custodians we will ensure that you exploit all of the multiple tax advantages and benefits associated with holding our enhanced annuity product(s) within your IRA and or other qualified retirement vehicle investment methods.

Our unique fully insured principal & interest protected investment note(s) provide our investors with the best way to put to use their self-directed traditional IRA or Roth IRA.

ROLLOVER OPTION

Our custodians manage over 10 billion dollars combined. We can quickly and easily help you roll over your existing IRA account(s) so you don’t miss out on earning interest or future investment opportunities.

SHORTER TERMS

Our Fully Insured Principal & Interest Protected Note™ Enhanced Annuity Offering(s) are available in several different term lengths ranging from 3, 5, 7, and 10 years. Generally speaking the longer the term length the higher the yield. Yet, even our longest term length note is shorter then most annuities while still paying out much higher yields.

*Longer terms and longer interest payment intervals typically result in higher yields.

HOW IT WORKS

1. INVEST IN OUR FULLY INSURED PRINCIPAL & INTEREST PROTECTED FIXED INCOME NOTE™️ | ENHANCED ANNUITY PRODUCT

You choose the amount you want to invest, how often you want to receive your regular interest payments and the length of time until your note matures.

2. GET MONTHLY DIRECT-DEPOSIT PAYMENTS

We deposit your monthly, quarterly or annual interest payments via ACH direct deposit directly into your bank account. The full amount of your principal investment is redeposited when your insured note reaches its maturity date. We’ve developed a retirement vehicle that delivers the ultimate in customer satisfaction with the ultimate APY!

3. SPEND YOUR TIME DOING WHAT YOU LOVE

This is a truly effortless passive investment. We handle all the due diligence, maintenance, administrative functions and management of your investment. Since both your principal and interest is guaranteed with an insurance policy, there is no risk therefore no anxiety. You spend your time doing what you love to do while your money works as hard for you as you did for it!

CURRENT OFFERINGS

OPTION ONE

3 Year Term

OPTION TWO

5 Year TERM

OPTION THREE

7 Year TERM

OPTION FOUR

10 Year TERM

INVESTMENT STRUCTURE

The current investment is provided through our Fully Insured Principal & Interest Protected Fixed Income Note™ | Enhanced Annuity Offering as follows:

* See info packet for additional information.

*depend on selected payment distribution option.

“Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman.”

- RONALD REAGAN

YES, I’M INTERESTED!

PLEASE SEND ME AN INFO PACKET

CLICK HERE FOR INVESTMENT OFFERINGTo qualify as an accredited investor, a person must have at least $200,000 in personal income, or $300,000 for combined incomes, over the past two years, with the expectation of the same or higher income in the current year. People with a net worth of more than $1 million jointly or with their spouse, excluding the value of their home, also qualify.

Disclaimer: This is not a solicitation to sell securities, which is only done through appropriate disclosure documents and only to qualified investors.

Translate

Translate